Cyber Insurance Demystified: Debunking Common Myths And Misconceptions

cyber insurance has become a crucial coverage for businesses of all sizes. However, there are still many myths and misconceptions surrounding cyber insurance that prevent businesses from understanding its importance.

In today's digital age, cyber insurance has become a crucial coverage for businesses of all sizes. However, there are still many myths and misconceptions surrounding cyber insurance that prevent businesses from understanding its importance. In this blog post, we will debunk some of the most common myths and misconceptions about cyber insurance, and shed light on why it is an essential coverage for every business.

Myth 1:"I'm not a big company, so I don't need cyber insurance."

One of the most common misconceptions about cyber insurance is that it is only necessary for large corporations. However, cyber threats can affect businesses of all sizes. Whether your client is a small manufacturing firm, restaurant, or realtor, their business is exposed to cyber risks. From data breaches to ransomware attacks, any business that relies on computer systems to handle sensitive customer information is at risk. Cyber insurance provides protection against these threats and may help to cover the financial losses incurred due to a cyber incident.

Myth 2: "I already have some form of cyber coverage."

Many business owners assume that they are already covered for cyber incidents through other insurance policies or service agreements. However, standard commercial insurance policies typically do not cover cyber risks adequately. Additionally, the terms and conditions offered by internet service providers or credit card processors may not provide comprehensive coverage. Cyber insurance is specifically designed to address the unique risks associated with cyber threats, including data breaches, business interruption, and legal expenses. It provides tailored protection for your insured's digital assets and liabilities.

Myth 3: "Cyber insurance is too expensive."

Another common myth is that cyber insurance is prohibitively expensive, especially for small to medium-sized businesses. While the cost of cyber insurance will vary depending on the size and nature of your insured's business, the potential financial impact of a cyber incident far outweighs the premium costs. The expenses associated with data breaches, system disruptions, and legal actions can be astronomical and potentially devastating for businesses. Cyber insurance offers financial protection and peace of mind, enabling businesses to recover more quickly and efficiently from a disastrous cyber incident.

Myth 4: "I can prevent cyber incidents with robust cybersecurity measures."

While investing in strong cybersecurity measures is crucial for mitigating cyber risks, it does not guarantee complete protection. Cybercriminals are constantly evolving their tactics, and even the most secure systems can be vulnerable to advanced cyber attacks. Cyber insurance complements your insured's cybersecurity efforts by providing an additional layer of protection.

In many cases, if your client wants cyber insurance, they will need to provide proof that they are proactive in their desire to mitigate threats. Comprehensive cyber protection is a mandatory prerequisite for most carriers. Luckily, Limit makes it easy to implement these solutions. From MFA software to incident response protection, you can find the solutions your insured needs by checking Limit's Cyber Marketplace.

Myth 5: "My business is too small to be a target."

Many small business owners believe that their size makes them less appealing to cybercriminals. However, this misconception is far from the truth. In fact, small businesses are often targeted precisely because they may have less sophisticated cybersecurity measures in place. Cybercriminals exploit this vulnerability and target smaller businesses for financial gain. Cyber insurance helps level the playing field by providing the necessary resources to mitigate the impact of a cyber incident and safeguard your insured's business reputation.

Conclusion

Cyber insurance is a vital coverage that all businesses should consider, regardless of their size or industry. By debunking these common myths and misconceptions, you can educate your client on the importance of cyber insurance in today's digital landscape. Protecting their business from the financial and reputational damage caused by cyber threats is not only practical but also necessary for long-term success.

The Limit Perspective

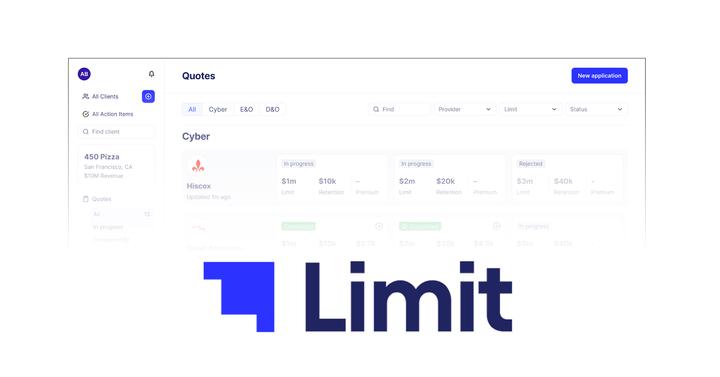

Limit is a digitally-native wholesale insurance broker working on behalf of retailers in multiple lines of insurance and across the United States. Our platform allows clients to:

- Obtain instant quotes from top cyber insurers

- Find up to $3M in Insurance coverage automatically

- Receive a plan with customizable and comprehensive coverage

- 24/7 support

Limit is building a lean, tech-enabled business that can efficiently deliver insurance policies which are tailored to the needs of individual clients. We have taken some of the first steps to revolutionizing the industry and welcome you to learn more on our website: www.limit.com

Please reach out and connect with us and our representatives on LinkedIn as well.