Navigating the Complexities of E&O Insurance: How to Choose the Right Coverage

In this article, we will delve into the complexities of E&O insurance and provide you with some valuable tips so you can help your clients choose the right coverage for their specific needs.

Errors and omissions (E&O) insurance, also known as professional liability insurance, plays a crucial role in protecting professionals from claims that may arise from providing expert advice or services to their clients. Whether your client is an accountant, lawyer, consultant, or any other professional, having the right E&O coverage is vital. In this article, we will delve into the complexities of E&O insurance and provide you with some valuable tips so you can help your clients choose the right coverage for their specific needs.

Defining Professionals and Their Coverage Needs

Before we explore E&O insurance, let's start by defining what constitutes a professional in the eyes of the insurance industry. Professionals are individuals or firms that offer specialized knowledge or skills through advice, guidance, or services to others. This typically requires specific licensing, training, or education. Examples of professionals span various fields, including lawyers, accountants, real estate brokers, consultants, architects, and more.

The Difference Between General Liability and Professional Liability Insurance

It's important to differentiate between general liability insurance and professional liability insurance. While general liability insurance may cover bodily injury, property damage, and personal injuries, professional liability insurance strictly excludes these claims. Instead, professional liability insurance focuses on claims that arise from providing professional services, advice, or guidance resulting in financial harm to clients.

Why Your Clients Need Both General Liability and Professional Liability Insurance

As professional service providers, your clients might find themselves needing both general liability and professional liability insurance. Let's consider a hypothetical scenario involving a consultant. Suppose a client visits the consultant's office and slips, injuring themselves. In this case, the general liability policy would respond to the claim. However, if the consultant provides advice or guidance that leads to the client suffering financial damages, it would be a professional liability claim. Therefore, having both policies ensures comprehensive coverage for different types of claims.

Significance of E&O Insurance and When Your Clients Need It

Now that we've established the importance of professional liability and E&O insurance, the question arises as to when your clients actually need it. There are a few scenarios where acquiring this coverage becomes necessary. Firstly, E&O insurance may be required as part of a contractural obligation. This is particularly common when your clients are involved in significant deals. It's crucial to satisfy your customer demands while safeguarding your client's business from potential claims.

Secondly, if your client's business falls into the category of providing professional services, it's essential to secure professional liability insurance. A general liability policy will not cover errors and omissions made while delivering services to clients. By obtaining professional liability insurance, your client can ensure that any claims arising from errors or omissions are adequately covered.

Coverages provided by E&O Insurance

When it comes to choosing the right E&O insurance, understanding the coverages provided is essential. Firstly, defense costs tend to be a critical component covered by this insurance. Even if a claim may eventually be dismissed, the costs involved in defending it can be substantial. Having E&O insurance may ensure that your client's defense costs, including lawyers' fees and related expenses, are covered.

Additionally, settlements can arise from professional liability claims, and they can be significant. Thus, it is crucial to have sufficient coverage limits that protect your clients financially. It is worth noting that many E&O policies are written on a claims-made basis, where defense costs are included in the limit of liability. As defense costs are expended, the available coverage limit reduces. While needs while vary on a case-by-case basis, it may be wise to opt for a higher coverage limit.

Final Thoughts

E&O insurance or professional liability insurance plays a crucial role in mitigating risks and protecting businesses from potential claims. The complexities surrounding E&O insurance necessitate careful consideration when selecting the right coverage. By understanding the specific needs of your insured you can navigate the intricacies and complexities of E&O insurance confidently.

Do you need assistance in finding the right professional liability insurance tailored to your client's needs? Please reach out to our team at retailers@limit.com.

The Limit Perspective

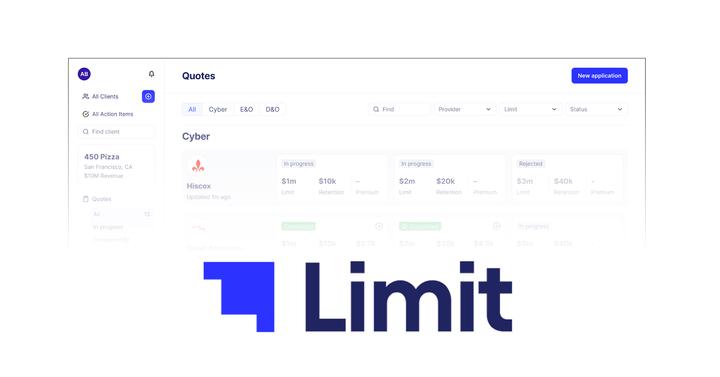

Limit is a digitally-native wholesale insurance broker working on behalf of retailers in multiple lines of insurance and across the United States. Our platform allows you to:

- Obtain instant quotes from top E&O carriers

- Find up to $3M in Insurance coverage automatically

- Receive a plan with customizable and comprehensive coverage

- 24/7 support

Limit is building a lean, tech-enabled business that can efficiently deliver insurance policies which are tailored to the needs of individual clients. We have taken some of the first steps to revolutionizing the industry and welcome you to learn more on our website: www.limit.com

Please reach out and connect with us and our representatives on LinkedIn as well.