Exploring the Types of Professionals Who Need E&O Insurance

Learn about the types of professionals who need E&O insurance and why it is essential for their businesses.

Professional liability insurance, also known as errors and omissions (E&O) insurance, is a crucial form of coverage for professionals who provide specialized advice, guidance, or services to clients. It protects professionals from potential claims that may arise from their professional activities. In this blog post, we will delve into the types of professionals who need E&O insurance and why it is essential for their businesses.

To understand who falls into the category of professionals needing E&O insurance, let's first define what a professional is in the context of the law and insurance. A professional is any person or firm that offers services requiring specialized knowledge or skills that the general public does not necessarily possess. These services often require licensing, specialized training, or education.

Some examples of professionals who typically require E&O insurance include lawyers, accountants, real estate brokers, consultants, financial advisors, stockbrokers, engineers, designers, architects, and personal service providers like barbers, beauticians, massage therapists, and personal coaches.

It's important to note that medical professionals, such as doctors, dentists, and surgeons, fall under a different category known as medical malpractice.

Additionally, there are specific E&O policy forms for technology companies, which cover claims arising from errors and omissions related to technology products and services. Though similar in concept, technology E&O insurance differs slightly other types of policy forms.

Now, your clients might be wondering about the difference between general liability and professional liability insurance and whether they need both. General liability insurance typically covers claims related to bodily injury, property damage, and personal injuries like advertising injury, libel, or slander. On the other hand, professional liability insurance often excludes claims for bodily injury and property damage. While there are some gray areas concerning personal injury claims, it varies from policy to policy and can be rather complex.

The key point to remember is that professional liability insurance covers claims that arise from providing professional services, advice, or guidance that lead to a client suffering financial harm. In most cases, professional service firms will need both general liability and professional liability insurance because they cover different types of claims.

To illustrate this further, let's consider a consultant as an example. A consulting firm providing professional advice to clients could face various scenarios. Suppose a client slips and falls in the consultant's office, resulting in injuries and a subsequent lawsuit. In this case, the general liability policy will respond to the bodily injury claim. However, if the claim is related to providing advice that leads to the client's financial damages, such as bankruptcy, the professional liability insurance would come into play. This example demonstrates the need for both types of coverage for a consultant's business.

Now, when do your clients need professional liability or E&O insurance? The answer is multifaceted. Firstly, they may be required to purchase E&O insurance by their customers when entering into a contract. Many professional clients insist on having professional liability coverage, especially for significant contracts. Obtaining coverage becomes crucial to satisfying the contract's demands and protecting your insured's business from potential claims.

Secondly, if your client's business falls into the category of providing professional services that require specialized knowledge or skills, their general liability insurance may not cover all errors and omissions made while delivering services to clients. Thus, professional liability or E&O insurance becomes a necessity to protect their business from financial losses stemming from lawsuits related to professional advice or services.

What does professional liability insurance cover? Defense costs are a vital part of E&O insurance coverage. Even if your clients believe they will never be sued for professional liability or feel confident in winning any claims, the reality is that defending against a lawsuit can be costly. E&O insurance covers defense costs, including lawyers' fees and other expenses. However, it's important to note that defense costs are usually deducted from the policy's limit of liability. Therefore, it's wise to purchase sufficient coverage to account for potential defense expenses.

Additionally, professional liability insurance covers settlement costs. These are the amounts your clients may have to pay to settle a claim successfully. Settlements can be substantial, making it crucial to have appropriate coverage in place.

For professionals like lawyers, accountants, and others, industry-specific coverage forms are available. However, there are also miscellaneous professional liability policies designed to cater to the unique needs of consultants and other service providers. The challenge with these policies lies in defining professional services broadly enough to cover all potential claims that may arise from the profession. This often requires negotiation between brokers and underwriters to ensure comprehensive coverage. Luckily, services like Limit make it easy for brokers to navigate these situations with minimal friction.

In conclusion, the range of professionals, advisors, and consultants who require E&O insurance is extensive. While some professions have their specialized coverage forms, others fall under miscellaneous professional liability policies. To get the right protection for your client's it is essential to have a broad understanding of the market. Doing so ensures that you can guide your clients in the right direction, regardless of their class of business.

The Limit Perspective

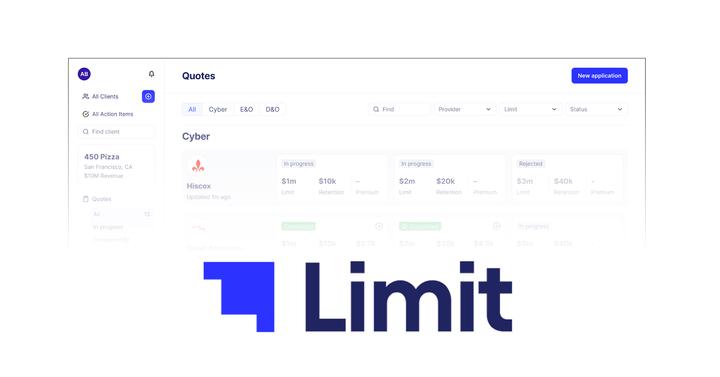

Limit is a digitally-native wholesale insurance broker working on behalf of retailers in multiple lines of insurance and across the United States. Our platform allows clients to:

- Obtain instant quotes from top cyber insurers

- Find up to $3M in Insurance coverage automatically

- Receive a plan with customizable and comprehensive coverage

- 24/7 support

Limit is building a lean, tech-enabled business that can efficiently deliver insurance policies which are tailored to the needs of individual clients. We have taken some of the first steps to revolutionizing the industry and welcome you to learn more on our website: www.limit.com

Please reach out and connect with us and our representatives on LinkedIn as well.