Why Professional Consultants Need E&O Insurance: Important Considerations

In this article, we will discuss the types of things professional consultants should take into consideration when growing their business.

Professional consultants are in high demand due to their expertise and advice. However, this line of business comes the responsibility of potential risks and liabilities that may arise from providing professional services. That's where Errors and Omissions (E&O) Insurance comes into the picture. In this article, we will discuss the types of things professional consultants should take into consideration when growing their business.

To understand the importance of E&O insurance, let's start by defining what a professional consultant is. In the context of the law and insurance, a professional refers to any person or firm that provides specialized knowledge or services to others, requiring expertise that the general public may not possess. This could include various professionals such as lawyers, accountants, real estate brokers, financial advisors, stockbrokers, engineers, designers, architects, and even personal service providers like barbers, beauticians, massage therapists, or life coaches.

Now that we've established who professional consultants are, let's dive into E&O insurance.

What is E&O Insurance?

E&O insurance, also known as professional liability insurance, is designed to protect professionals from claims that may arise due to errors, omissions, or negligence in their professional advice, guidance, or services.

Your clients might ask why they need E&O insurance. Here are a few things to keep in mind when answering this question.

1. Contractual requirements

Many clients, especially when entering into a new contract, may require professional consultants to have E&O insurance. This is to protect both parties from potential claims that may arise during the course of the engagement.

2. Coverage for professional services

While general liability insurance may cover bodily injury, property damage, and personal injuries, it does not cover claims arising from errors and omissions in providing professional services. E&O insurance fills that gap, specifically addressing claims related to financial harm caused by professional advice or guidance.

3. Defense costs

One of the most crucial aspects of E&O insurance is its coverage for defense costs. Even if a claim is eventually dismissed, the legal fees and other associated costs can be significant. E&O insurance may cover these defense costs, making it easier for your insureds to recover from potential claims.

4. Settlement costs

In situations where a settlement is reached to resolve a claim, the amount owed by the insured can be substantial. E&O insurance may cover these settlement costs, providing consultants with peace of mind in the form of financial protection.

While traditional professional categories, such as lawyers or real estate brokers, have specific coverage forms tailored to their respective professions, there is a broad category of consultants and advisors that fall under the umbrella of Miscellaneous Professional Liability (MPL) insurance. For these professionals, defining the scope of professional services is crucial to ensure that all potential claims are covered.

Conclusion

In conclusion, E&O insurance is a vital consideration for professional consultants. It not only satisfies contractual requirements, but it may also provide essential coverage for errors, omissions, and negligence in professional services.

The Limit Perspective

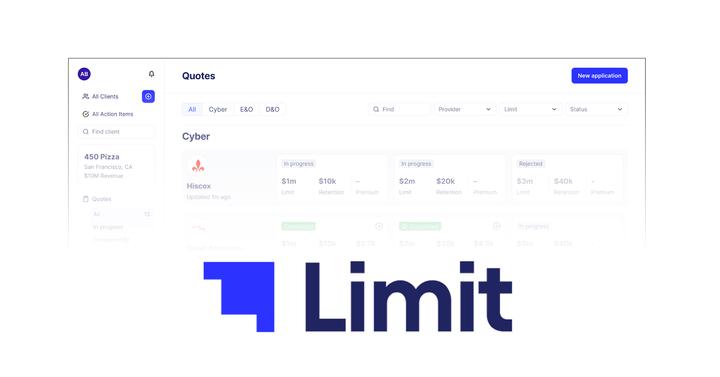

Limit is a digitally-native wholesale insurance broker working on behalf of retailers in multiple lines of insurance and across the United States. Our platform allows clients to:

- Obtain instant quotes from top cyber insurers

- Find up to $3M in Insurance coverage automatically

- Receive a plan with customizable and comprehensive coverage

- 24/7 support

Limit is building a lean, tech-enabled business that can efficiently deliver insurance policies which are tailored to the needs of individual clients. We have taken some of the first steps to revolutionizing the industry and welcome you to learn more on our website: www.limit.com

Please reach out and connect with us and our representatives on LinkedIn as well.